Merchant Obligations and Processing Suggestions: What Every Merchant Must Know

When accepting or processing credit card payments, merchants must follow specific rules to protect their business and stay compliant with card network regulations. Failure to meet these requirements can lead to immediate termination of a merchant processing account.

Below is a clear list of key obligations for all merchants.

Essential Merchant Obligations

1. Do Not Process Transactions for Another Business

Merchants are strictly prohibited from using their terminal to process Visa or MasterCard payments for another merchant.

➡ This practice—known as factoring—is illegal and can result in account termination.

2. Do Not Exceed Hand-Keyed Transaction Limits

Hand-entered transactions cannot exceed the percentage allowed in the merchant agreement unless the merchant receives written approval from Card & Beyond.

3. No Cash Advances Through Credit Card Deposits

Merchants may not deposit transactions for the purpose of obtaining or giving a cash advance.

4. Keep the Merchant Account Active

Your merchant account must be activated within 90 days of receiving your merchant number.

It should also not remain inactive for more than 90 days without notifying Card & Beyond.

5. Do Not Impose a Credit Card Surcharge

Merchants cannot add extra fees for credit card payments.

(Note: Some states allow regulated surcharging, but merchants using Card & Beyond may NOT apply surcharges unless specifically permitted.)

6. Do Not Request Additional Identification

When a valid credit card is properly presented, merchants cannot require the cardholder to show extra identification or personal information.

7. No Minimum or Maximum Credit Card Purchase Amounts

Cardholders must be allowed to pay with their credit card without limits such as minimum spend requirements.

8. Notify Card & Beyond Before Changing Your Business Type

Merchants must inform Card & Beyond in writing before changing the nature of their business or selling services/products outside their approved category.

9. Obtain an Imprint When the Card Cannot Be Swiped

If the card cannot be swiped, an imprint of the physical card must be captured for security and dispute protection.

10. Close Your Batch Daily

Merchants should perform a daily batch close to ensure transactions are transmitted promptly.

If your terminal auto-closes, verify that all transactions were successfully sent.

11. Do Not Split a Transaction

Merchants cannot divide one transaction into multiple smaller transactions.

Monitoring for Unusual Activity

Card & Beyond monitors merchant accounts daily. If unusual transaction activity is detected, funds may be temporarily held while an investigation is performed.

➡ This is a standard security measure to protect merchants, cardholders, and the payment network.

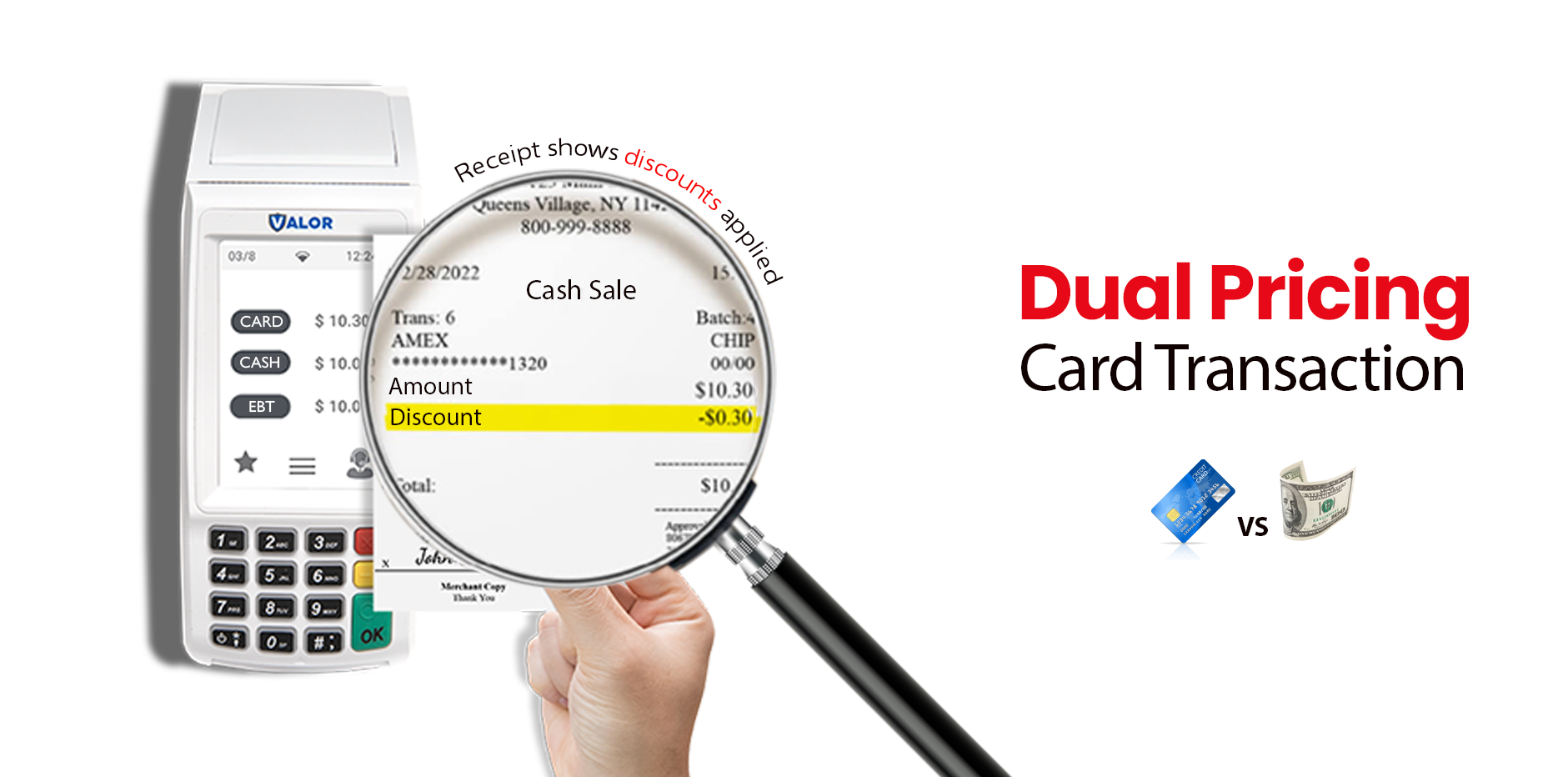

💬 Need more information about Dual Pricing?

Our Customer Support Team is ready to assist you.

📞 Contact: +1-800-495-0122

🌐 Website: https://cardandbeyond.com

.png)

.jpg)