Essential Rules for Processing Card Transactions

When processing credit card payments, merchants must follow key rules to stay compliant and protect their business from fraud or liability. Proper handling of each transaction reduces risk and ensures smooth payment operations.

Essential Rules for Credit Card Processing

- All card transactions should be electronically read (swiped, EMV chip inserted, etc.).

- Always check whether the numbers displayed on the terminal or receipt match the embossed numbers on the physical card.

- If your terminal does not display the card number when swiped, contact Card & Beyond Technical Support at 1-800-495-0122 to receive a free fraud-protection software update.

Additional rules include:

- If a card cannot be electronically read, take a manual imprint of the card.

- Verify the signature on the receipt with the signature on the back of the card.

- Do not accept any card that appears tampered with or physically altered.

- Never process transactions for another business.

- Do not accept card numbers over the phone unless Card & Beyond has pre-approved you to do so.

- Always maintain accurate records of all transactions.

- Be cautious of customers making unusual or out-of-pattern purchases.

How to Respond to Suspected Fraud

If you believe a transaction may be fraudulent, call your voice authorization center immediately and inform the operator you are requesting a CODE 10 authorization. The operator will guide you through the correct steps.

When You Are Asked to “Pick Up” a Card

In some cases, your terminal or the voice operator may instruct you to take or “pick up” the card.

This usually happens because the card has been reported lost or stolen.

Important Safety Reminder

Always avoid confrontation with the cardholder.

Your safety and the safety of your staff come first.

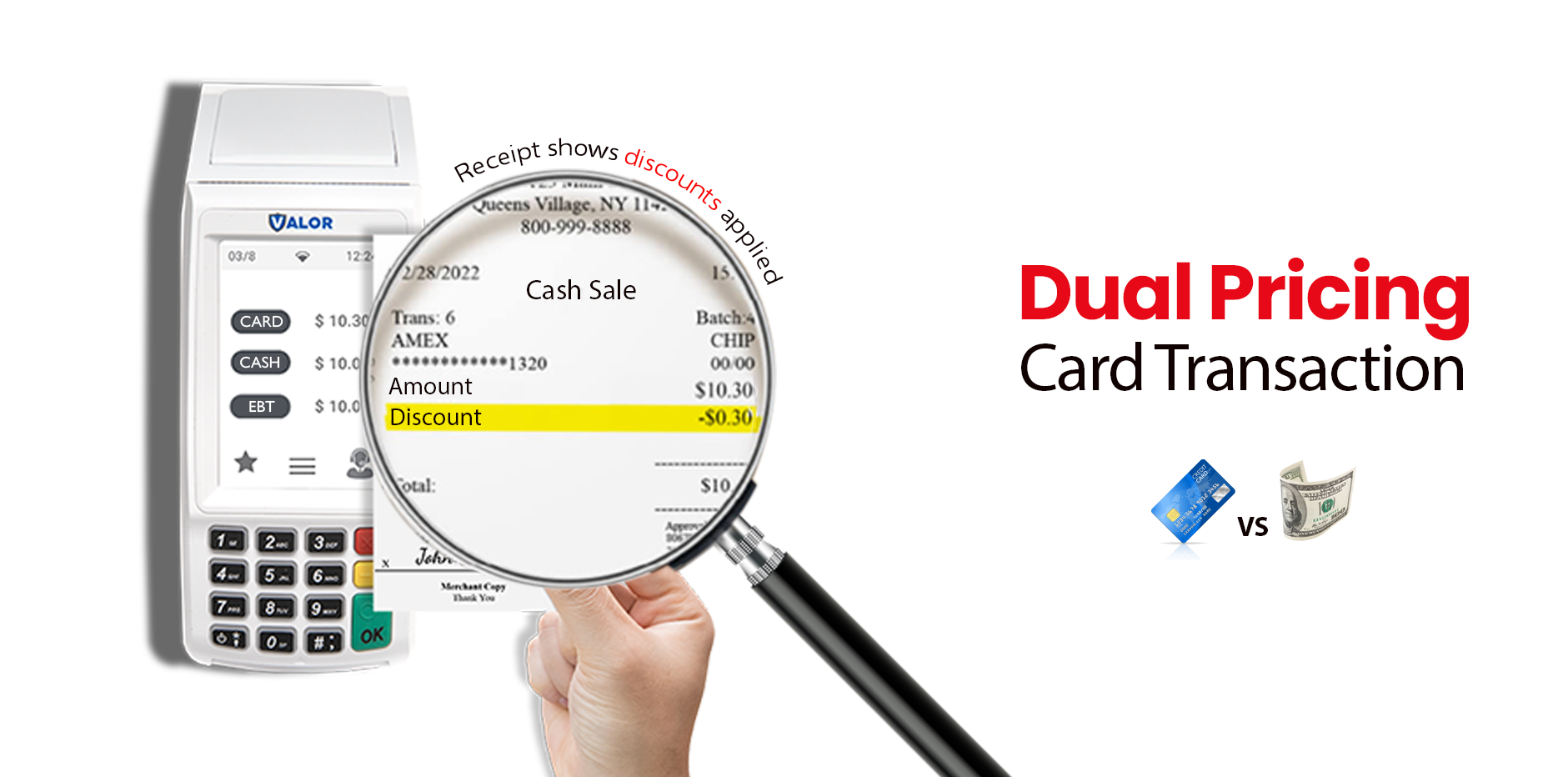

💬 Need more information about Dual Pricing?

Our Customer Support Team is ready to assist you.

📞 Contact: +1-800-495-0122

🌐 Website: https://cardandbeyond.com

.jpg)