What Is a Chargeback? A Clear Guide for Merchants

A chargeback occurs when a card issuer reverses a transaction and returns the dollar amount back to the cardholder—placing the financial liability on the merchant. In simple terms, it undoes a sale:

- The cardholder’s issuing bank subtracts the transaction amount.

- The merchant’s bank debits the same amount from the merchant’s account.

Chargebacks can be expensive because merchants may lose the transaction amount, the merchandise, and additional internal processing costs. In severe cases, too many chargebacks can even lead to termination of the merchant’s processing account.

To protect your business, it’s essential to reduce chargebacks whenever possible. Encourage customers to contact you directly with any issues before they reach out to their bank. Many disputes can be resolved long before they become chargebacks.

Common Chargeback Reasons & How Merchants Can Resolve Them

1. Non-Receipt of Requested Retrieval Item

If a merchant fails to provide the requested sales draft, the card issuer will debit the merchant's account.

➡ This chargeback cannot be reversed, so proper record-keeping is critical.

2. Unauthorized Mail Order / Telephone Order Transaction

This happens when a cardholder claims they did not authorize a mail or phone order.

Because these transactions lack a signature, merchants accept them at their own risk.

To fight this type of chargeback, merchants must keep:

- Order details

- Shipping records

- Any documentation proving the cardholder placed the order

➡ Strong, organized records can help verify the transaction.

3. Duplicate Processing

A chargeback is issued when a customer is billed more than once for a single authorized transaction.

Merchants can reverse this chargeback by supplying:

- Multiple signed and authorized sales drafts

- Each draft with a different invoice number

➡ Double-check your system to avoid duplicate transactions.

4. Non-Receipt of Merchandise

The customer claims they were billed for a product they never received.

This chargeback can be reversed if the merchant provides:

- A shipping receipt

- Signed proof of delivery from the cardholder

➡ Always use trackable shipping with signature confirmation for high-value orders.

5. Missing Signature or Missing Imprint

If a sales draft lacks a customer signature or card imprint, the issuing bank may charge it back.

Merchants should always:

- Ensure all sales drafts or terminal slips are signed

- Compare the signature with the back of the card

- Capture an imprint for every hand-keyed transaction (unless the card was swiped)

➡ Clear authorization reduces the risk of disputes.

What Happens After a Chargeback?

If Card & Beyond determines a chargeback is valid:

- The merchant’s account is debited for the amount of the sale.

- A Chargeback Adjustment Advice, along with supporting documentation, is sent to the merchant on the same day the debit is processed.

How to Reduce Chargebacks

- Provide clear receipts and order confirmations

- Ship products with trackable methods

- Respond quickly to customer complaints

- Keep detailed records for all transactions

- Train staff to follow proper authorization procedures

By taking proactive steps, merchants can significantly reduce financial losses and maintain a healthy processing account.

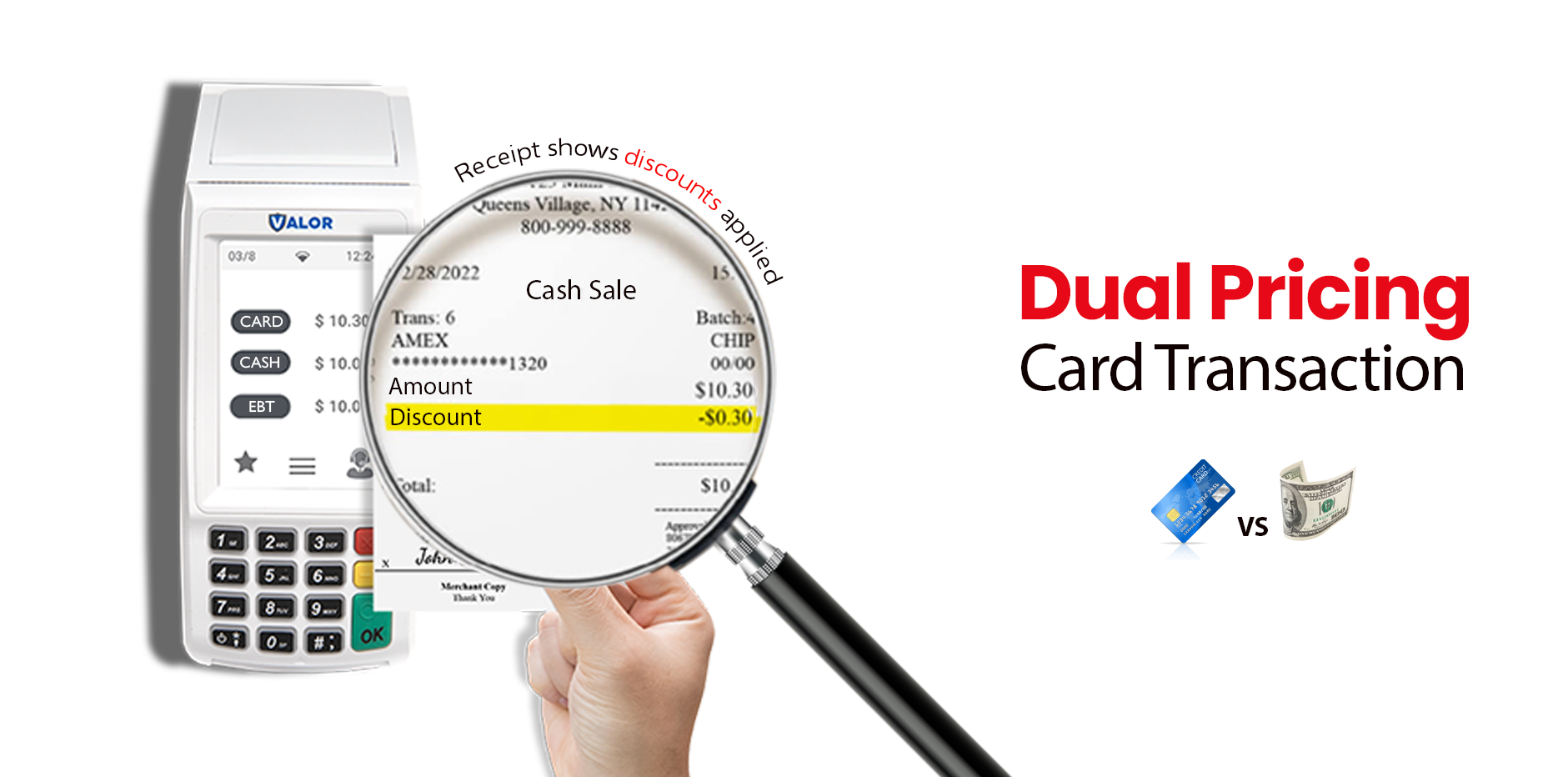

💬 Need more information about Dual Pricing?

Our Customer Support Team is ready to assist you.

📞 Contact: +1-800-495-0122

🌐 Website: https://cardandbeyond.com

.jpg)