by cardandbeyond | Jun 9, 2023 | Resources - ENGLISH

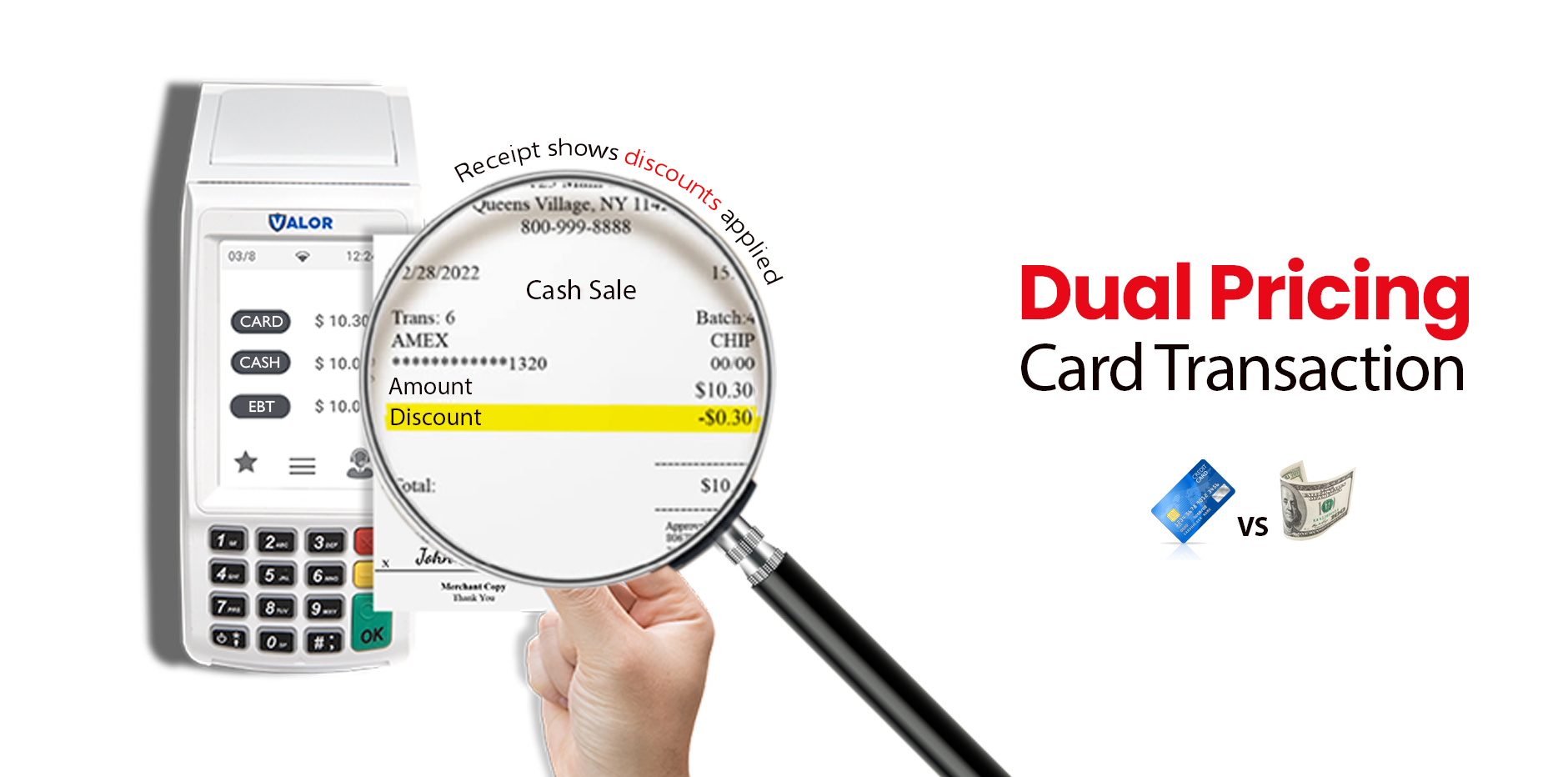

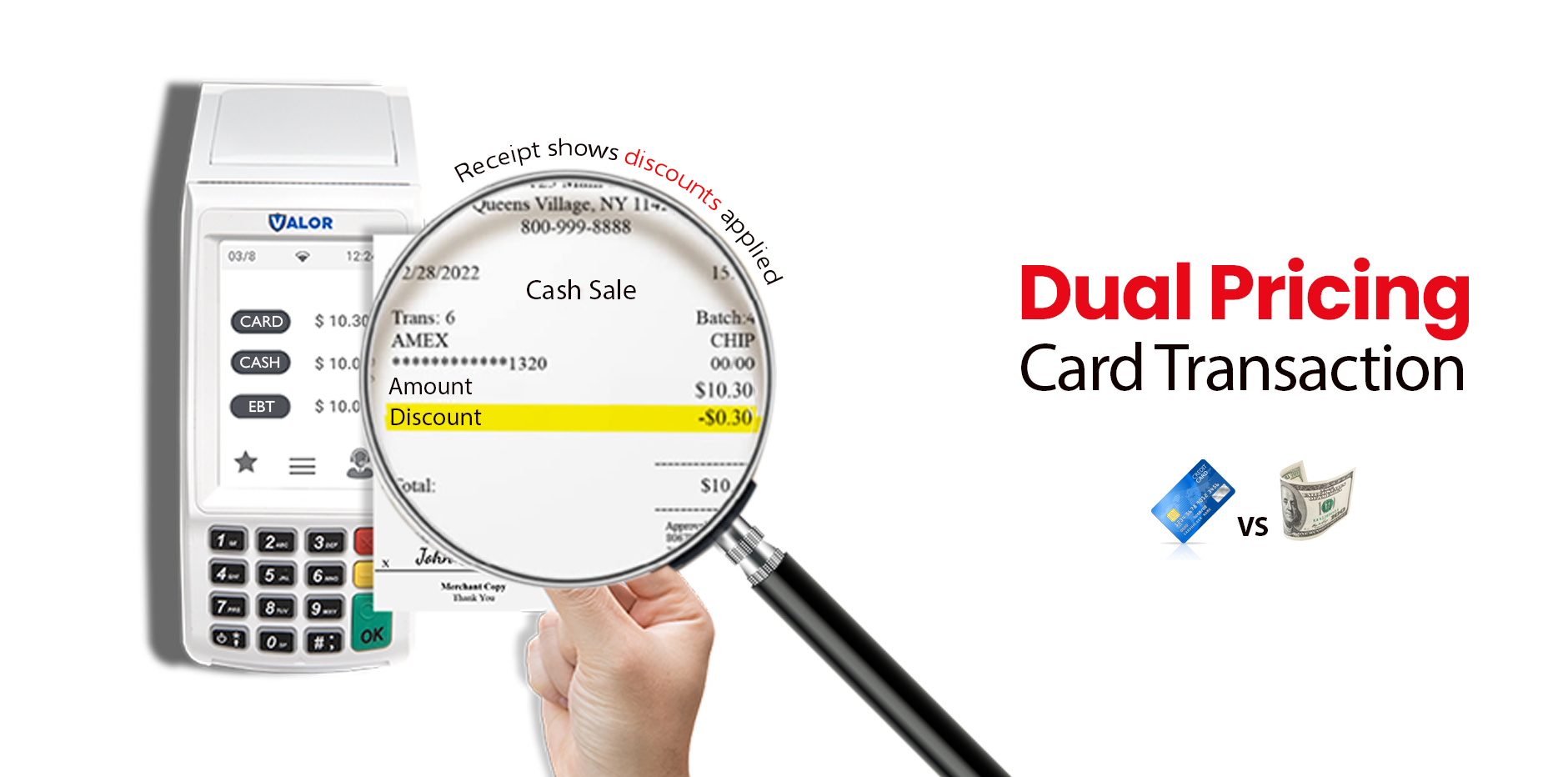

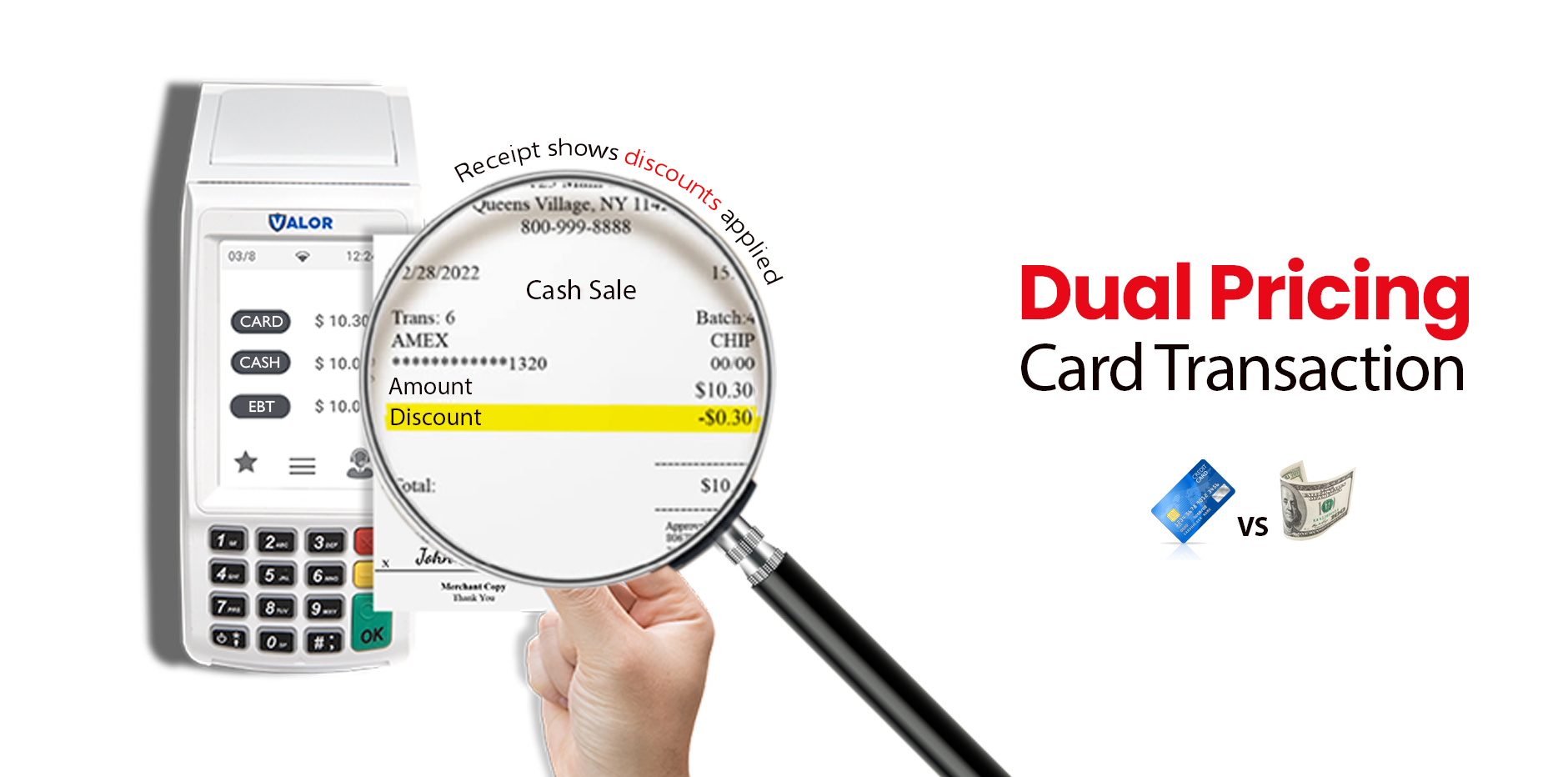

KOREAN 한글 Dual Pricing is not new. Many gas stations around the nation have been offering both cash and credit prices for over a decade. The benefit to the business owner is no secret. When businesses offer dual pricing, they retain 100% of the cash price...

by cardandbeyond | Apr 21, 2023 | Resources - ENGLISH

KOREAN 한글 Effective May 1, 2023 This adjustment is necessary for us to continue delivering new and enhanced tools for our platform, such as the ability for your merchants to accept a wider range of payment types and integrate their Clover system with other tools that...

by cardandbeyond | Oct 17, 2022 | Resources - ENGLISH

KOREAN 한글 ▶ Apple, Google, and Samsung Pay payment methods are supported, and card terminal is free▶ No contracts, No minimum processing fee, No termination fee Point of Sale systems are now a key player in business strategies for businesses. This is because it is...

by cardandbeyond | Sep 16, 2022 | Resources - ENGLISH

KOREAN 한글 Businesses with credit card sales can receive business operating funds. It’s an advance of funds based on your future sales. With clear and easy payback terms, you’ll have flexibility that you need to invest in your business. Easy approvalApply faster than...

by cardandbeyond | Jul 8, 2022 | Resources - ENGLISH

KOREAN 한글 Where To Start Social Media Marketing As A Business Owner? You are selling a great product or service, but looking for a way to advertise?Google, Instagram, Facebook… Among the diverse social media platforms, which one should I do first? The real “POPULAR”...

by cardandbeyond | Apr 7, 2022 | Resources - ENGLISH

KOREAN 한글 Form 1099-K, Payment Card and Third-Party Network Transactions, is an IRS information return used to report certain payment transactions to improve voluntary tax compliance. You should receive Form 1099-K by January 31st if, in the prior calendar year, you...